Your Family Bank: The $700,000 Case Study

Behind the scenes look at a real family and how they changed their life...

How We Took 1 Family, Made a Few Simple Tweaks to How They Were Paying Debt Off & Saving for Retirement & Erased Their Debt in Just over 8 Years and Increased Their Retirement Savings by over $800,000...

How We Took 1 Family, Made a Few Simple Tweaks to How They Were Paying Debt Off & Saving for Retirement & Erased Their Debt in Just 8 Years and Increased Their Retirement Savings by over $800,000...

Hi, my name is Larry McLean and I'm the founder and President of Your Family Bank!

I wanted to take a quick second and tell you my story and how Your Family Bank was first thought of and how it turned into what it is today.

It all started with football. See, I'm a huge Florida State fan and go to almost all the games. One fall Saturday in Tallahassee, as I sat there with 80,000 of my closest friends, I looked around the stadium and realized that of these 80,000 fans, maybe a couple hundred (at most) would be potential clients for us.

Up until this point we only worked in the senior market. With people who had already retired or were getting ready to and what we saw was alarming. They weren't prepared. At all. They were in debt or had just got out, there savings were lacking because of all the interest they had paid over the years and they were going to get killed by taxes when they started taking their money out to live on.

Basically, they had been doing it all wrong!

It was at that moment as I looked around at those 80,000 people that I knew something had to change. I had to do something that could help ALL of them, no matter what stage of life they were in. That moment, in my mind, was when, what is now Your Family Bank, was created.

We began doing some research and what we found backed up what we were seeing. We are going to share that with you below and also give you the opportunity to download an Exclusive Case Study of one of our first "new" clients and how we were able to change their lives.

Enjoy...

Larry

Hi, my name is Larry McLean and I'm the founder and President of Your Family Bank!

I wanted to take a quick second and tell you my story and how Your Family Bank was first thought of and how it turned into what it is today.

It all started with football. See, I'm a huge Florida State fan and go to almost all the games. One fall Saturday in Tallahassee, as I sat there with 80,000 of my closest friends, I looked around the stadium and realized that of these 80,000 fans, maybe a couple hundred (at most) would be potential clients for us.

Up until this point we only worked in the senior market. With people who had already retired or were getting ready to and what we saw was alarming. They weren't prepared. At all. They were in debt or had just got out, there savings were lacking because of all the interest they had paid over the years and they were going to get killed by taxes when they started taking their money out to live on.

Basically, they had been doing it all wrong!

It was at that moment as I looked around at those 80,000 people that I knew something had to change. I had to do something that could help ALL of them, no matter what stage of life they were in. That moment, in my mind, was when, what is now Your Family Bank, was created.

We began doing some research and what we found backed up what we were seeing. We are going to share that with you below and also give you the opportunity to download an Exclusive Case Study of one of our first "new" clients and how we were able to change their lives.

Enjoy...

Larry

THE PROBLEM: YOU'VE BEEN LIED TO!!!

THE PROBLEM: YOU'VE BEEN

LIED TO!!!

The average person is going to earn $2 million during their lifetime. According the the latest statistics from the IRS, FDIC and Census Bureau, at age 65 these same people will wind up with about $65,000 in net worth, including the equity in their house.

That is certainly not the American dream after having $2 million pass through their hands.

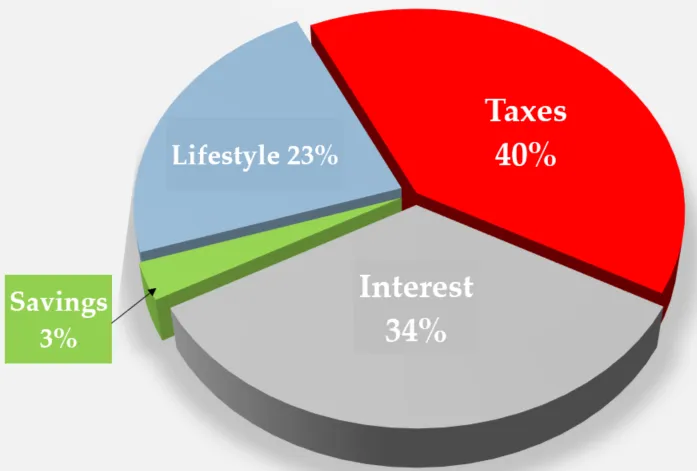

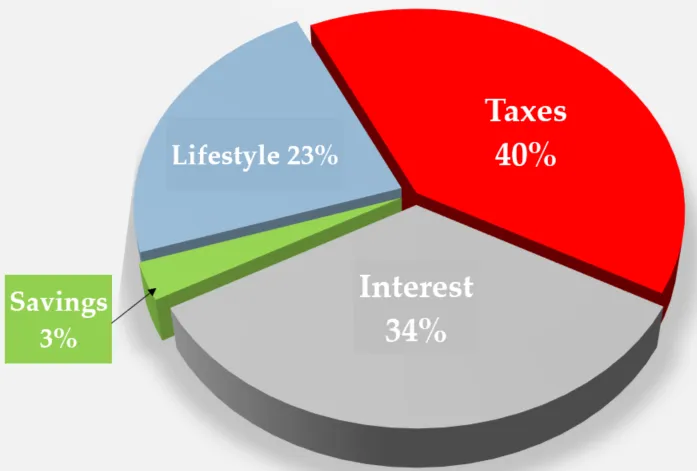

Let me draw this out for you like a pie chart.

So here we see the average person saves about 3% of their $2 million, that’s $60,000. The average person pays 34% of the money they earn in their lifetime out to interest. That interest is cars, credit cards, college, mortgages, all those types of things we finance, that is the interest going out ...and we pay taxes!

I’m talking about everything from income tax to gas tax, water tax, sales tax, etc.

So that leaves about 23% of our money left to live on. This is what we call our lifestyle money. That’s what we have to pay everything else with. Like our gas, car, insurance, food, entertainment... all those things that are left over after taxes and interest.

What most financial advisors do is concentrate on that 3% savings.

You know what they’ve told all of us, “Save more money. Give me your money, I'm better than the guy you have now”.

Guess what, most people can't save more money. Lots of us are doing the best we can.

So looking at this chart, what we try to focus on is the 34%. What if we could reduce that 34% and also reduce taxes? Well that would give us more lifestyle money and it would also increase our savings.

Using the Your Family Bank 7 Step System, we can do just that by showing people how to use the same money in a better, more efficient, safer way...

The average person is going to earn $2 million during their lifetime. According the the latest statistics from the IRS, FDIC and Census Bureau, at age 65 these same people will wind up with about $65,000 in net worth, including the equity in their house.

That is certainly not the American dream after having $2 million pass through their hands.

Let me draw this out for you like a pie chart.

So here we see the average person saves about 3% of their $2 million, that’s $60,000. The average person pays 34% of the money they earn in their lifetime out to interest. That interest is cars, credit cards, college, mortgages, all those types of things we finance, that is the interest going out ...and we pay taxes!

I’m talking about everything from income tax to gas tax, water tax, sales tax, etc.

So that leaves about 23% of our money left to live on. This is what we call our lifestyle money. That’s what we have to pay everything else with. Like our gas, car, insurance, food, entertainment... all those things that are left over after taxes and interest.

What most financial advisors do is concentrate on that 3% savings.

You know what they’ve told all of us, “Save more money. Give me your money, I'm better than the guy you have now”.

Guess what, most people can't save more money. Lots of us are doing the best we can.

So looking at this chart, what we try to focus on is the 34%. What if we could reduce that 34% and also reduce taxes? Well that would give us more lifestyle money and it would also increase our savings.

Using the Your Family Bank 7 Step System, we can do just that by showing people how to use the same money in a better, more efficient, safer way...

Isn't that awesome! I still get excited when I read about what we are able to do for families now...

So all that is left now is to get this Case Study in your hands. Just to review, you are going to get the full Mark & Joyce story of how they were able to:

-- Erase their debt in just over 7 years instead of 27 years - 20 YEARS SOONER

-- Increase their Retirement Nest Egg by OVER $800,000!!!

-- How they did all of this USING THE SAME MONEY THEY WERE ALREADY SPENDING

That's the beauty of Your Family Bank - you can do all of this without spending any more money than you are today! Alright already, I'll shut up now...

The next step is to get the full case study and set up a no-cost consultation with us.

This will cost you nothing and will show you a comparison of what you're doing now versus what you could be doing implementing Your Family Bank. We call it our "Big Picture Report" and we will give that to you Free of Charge.

BONUS - We're going to show you a FREE VIDEO that will introduce you to Mark & Joyce and the Your Family Bank concepts more in depth.

As you can see below, we will lay it out side by side so you can see the difference and if it makes sense for you.

Current Plan

- The exact month you will be out of debt

-

How much interest you will pay on this debt

-

How much you will have in your Retirement Account at 65 (or whatever age you want to see)

-

How much you will pay in taxes in Retirement to access your money

-

How long that money will last you

Your Family Bank Plan

- The exact month you will be out of debt compared to Current

-

How much interest you would save over current plan

-

How much you will have in your Retirement Accounts at 65 (or whatever age you choose)

-

How many Tax Dollars you will save over traditional Retirement accounts

-

How long your tax favored money will last you

Here is what a Big Picture Report Looks Like

Isn't that awesome! I still get excited when I read about what we are able to do for families now...

So all that is left now is to get this Case Study in your hands. Just to review, you are going to get the full Mark & Joyce story of how they were able to:

-- Erase their debt in just over 7 years instead of 27 years - 20 YEARS SOONER

-- Increase their Retirement Nest Egg by OVER $800,000!!!

-- How they did all of this USING THE SAME MONEY THEY WERE ALREADY SPENDING

That's the beauty of Your Family Bank - you can do all of this without spending any more money than you are today! Alright already, I'll shut up now...

The next step is to get the full case study and set up a no-cost consultation with us.

This will cost you nothing and will show you a comparison of what you're doing now versus what you could be doing implementing Your Family Bank. We call it our "Big Picture Report" and we will give that to you Free of Charge.

BONUS - We're going to show you a FREE VIDEO that will introduce you to Mark & Joyce and the Your Family Bank concepts more in depth.

As you can see below, we will lay it out side by side so you can see the difference and if it makes sense for you.

Current Plan

- The exact month you will be out of debt

-

How much interest you will pay on this debt

-

How much you will have in your Retirement Account at 65 (or whatever age you want to see)

-

How much you will pay in taxes in Retirement to access your money

-

How long that money will last you

Your Family Bank Plan

- The exact month you will be out of debt compared to Current

-

How much interest you would save over current plan

-

How much you will have in your Retirement Accounts at 65 (or whatever age you choose)

-

How many Tax Dollars you will save over traditional Retirement accounts

-

How long your tax favored money will last you

Here is what a Big Picture Report Looks Like